Gifts-in-kind, GIK, in-kind, non-cash, call it what you may, the reporting principles surrounding non-financial assets such as donated goods and services have eternally been silent. This silence has led to substantial diversity in practice in the nonprofit accounting community, which has resulted in financial statements that lack comparability and consistency. Until now.

In September of 2020, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2020-07 effective for fiscal years beginning after June 15, 2021 (translation: fiscal years ending June 30, 2022 and calendar years ending December 31, 2022). ASU 2020-07 amends Accounting Standards Codification (ASC) 958-605 and now requires the following presentation changes for nonprofit organizations who received donated goods or services:

- Present contributed non-financial assets as a separate line item in the statement of activities, apart from contributions of cash and other financial assets

- Additional disclosure requirements surrounding contributed nonfinancial assets

Let’s break this down further. First, a non-financial asset is defined by accounting standards as: an asset that is not a financial asset (shocking!). Non-financial assets include land, buildings, use of facilities or utilities, materials and supplies, intangible assets, or services.

IMPORTANT NOTE: the FASB opted not to include contributed securities and other financial assets within the scope of this standard because contributed financial assets other than cash (stock, bonds, equities, etc.) are usually monetized and used similarly to cash.

Now that nonfinancial assets (gifts-in-kind, GIK, in-kind, non-cash contributions, etc.) have been separately identified, we can address the effects of the new provision. ASU 2020-07 changes presentation requirements and increases disclosure requirements but does not change the recognition and measurement components of accounting for donated goods and services. That is an important concept to remember, the actual journal entry to recognize GIK transactions is not changing, only where these transactions land on the financial statements as well as how they are described in the footnotes.

Let’s dig deeper:

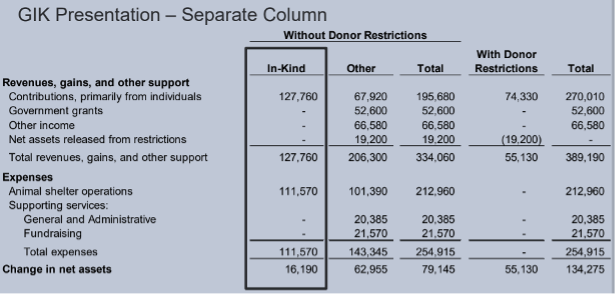

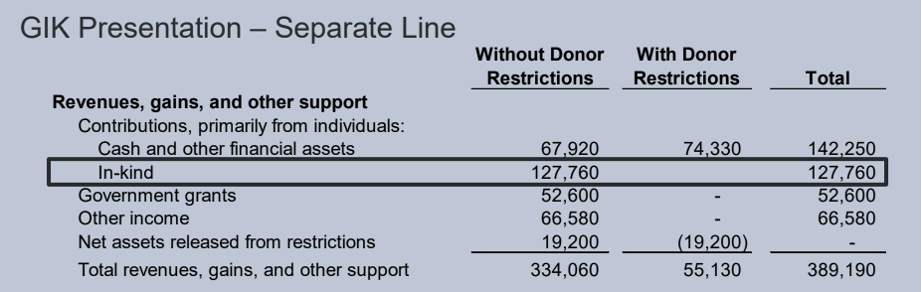

- Changes to Presentation: Nonprofits must present GIK as a separate line item in the statement of activities apart from other contributions received by the nonprofit. Organizations have the option of presenting this information as simply a new line in the revenue section or as a completely new column on the statement of activities. An organization who deals heavily in non-cash transactions throughout grants, programs, and special events, may find it most efficient to utilize the columnar format to capture all GIK components in one place.

- Additional Disclosure Requirements: Nonprofits will be required to disclose the disaggregation of the amount of contributed goods and services reported on the statement of activities by category that best depicts the type of contributed non-financial assets. Examples include vehicles, clothing, medical supplies, buildings, food, and services. Additionally, for each category of non-financial asset reported, organizations must disclose the following:

- Qualitative information about whether contributed goods and services were monetized (sold) or utilized during the reporting period

- If utilized, a description of the programs or other activities in which the contributed non-financial assets were used

- The organization’s policy about monetizing versus utilizing contributed non-financial assets, if such a policy exists

- A description of any donor-imposed restrictions on the use of contributed non-financial assets

- A description of the valuation techniques and inputs utilized to determine the fair market value of donated goods and services

- Identification of the principal, or most advantageous, market used to determine the fair market value if it is a market in which the recipient organization is prohibited by a donor-imposed restriction from selling or using the contributed non-financial asset

IMPORTANT NOTE: Although this ASU is effective for fiscal years beginning after June 15, 2021, the FASB indicates this standard must be applied retrospectively. Accordingly, nonprofits will need to be prepared to provide the required disclosures for fiscal years beginning after June 15, 2020 (fiscal years ending June 30, 2021 and calendar years ending December 31, 2021) if comparative financial statements are presented. As part of the retrospective presentation, nonprofits must include transitional disclosures as required by ASU 250-10-50-1 in the period of adoption. These disclosures include:

- The nature of, and reason for, the change in accounting principle, including an explanation of the newly adopted accounting principle

- The method of applying the change

- A description of the prior period information that has been retrospectively adjusted, if any

- The effect of the change on relevant financial statement line items

The FASB has communicated that a Post-Implementation Review (PIR) will be conducted once ASU 2020-07 becomes effective. The intent behind the PIR is to determine whether this standard accomplished its stated purpose of providing comparability and increased transparency in the nonprofit financial reporting framework.

For more information or to discuss specific questions you have regarding your organization’s GIK reporting framework, contact info@everreenalliancecpa.com